|

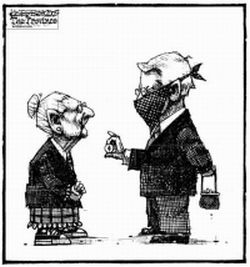

After setting the record for the largest deficit in British Columbia history only two years ago, Gordon Campbell‘s Liberal government is about to close out 2004/05 with B.C.’s largest-ever surplus, at around $2 billion.

With the February 15th ‘Golden Era’ budget have the Lie-berals made the decision to reduce poverty and re-invest in public services for the benefit of all British Columbians? According to David Schreck, at Strategic Thoughts, the answer is: no.

The 2005 budget threw a few crumbs back to the masses in an attempt to buy forgiveness and the election, (translating) into a benefit of $34 a year compared to more than $20,000 a year they gave to top income earners in 2001. The spending side of the budget also looks like crumbs when the announcements are put in perspective relative to past cuts: if all of the monies for the homeless that were announced in Budget 2005 went just to the City of Vancouver, it wouldn’t scratch the surface of the problem; as well, under the Campbell government’s plan it will take until 2008 to get back to the 2001 level of funding for adult community living services; and remember June 2001 when the Campbell government announced $1.5 billion in personal income tax cuts … just 11,000 tax filers who report incomes in excess of $250,000 per year, received $200 million in tax cuts, or $20,000 a piece, while the rest of us had our taxes reduced by $34 to $386 a year.

Is B.C. doing better than it was four years ago, and is the current record surplus due to prudent Lie-beral fiscal management? VanRamblings suggests: absolutely not. Why is B.C. running a budget surplus? Could draconian cuts to services to children, seniors, the disabled and the very poorest among us have anything to do with the surplus? Yes.

Are record federal transfer payments to B.C. for health care and equalization a factor in our budget surplus? Yes. Are Crown Corporation revenues adding to the provincial bottom line, including a 50% increase in gambling revenues? Yes. Are large revenue gains that stem from Medical Service Plan premium hikes, tuition fee increases, and windfalls in property taxes and resource royalties also factors? Yes, again.

The next provincial election, May 17th, is only 86 days away. Will you be voting Lie-beral this time out?